Municipalities Could Face Budgetary Pressures Due to SALT Cap

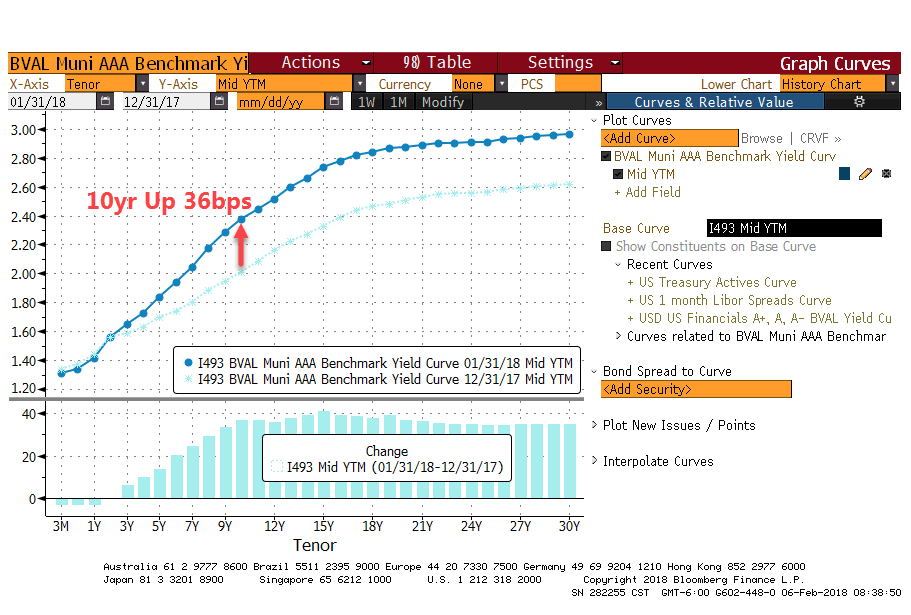

Municipal market participants have had more than a month to digest the impact of the Tax Cuts and Jobs Act (TCJA). To date, it appears that munis have effectively priced-in the impact of lower tax rates. Last September, we published “An Update on Tax Reform” (www.GoBaker.com/ag101) and in it, we showed that under the proposed tax rate of 20% for C Corp institutions, 10-year muni yields would need to be 40bps higher if investors demand the same tax equivalent yield. On December 18, 2017,the TCJA was officially signed into law, landing on a 21% corporate tax rate. Through the end of last month, yields on Bloomberg’s 10-year Benchmark Municipal Index had increased 36bps (Figure 1).

Figure 1: BVAL Municipal AAA Benchmark Yield Curve

December 2017 - January 2018 If interest rates continue to rise, municipalities will face higher borrowing costs, which could negatively impact credit quality for certain obligors. Moreover, the removal of future advanced refunding issuance will also inhibit an issuer’s ability to reduce their cost of funds. There are two other provisions of the TCJA that could create budgetary pressures for municipal issuers:

If interest rates continue to rise, municipalities will face higher borrowing costs, which could negatively impact credit quality for certain obligors. Moreover, the removal of future advanced refunding issuance will also inhibit an issuer’s ability to reduce their cost of funds. There are two other provisions of the TCJA that could create budgetary pressures for municipal issuers:

- The cap on interest deductions on new mortgages over $750K

- A $10,000 limit on state and local tax (SALT) deductions

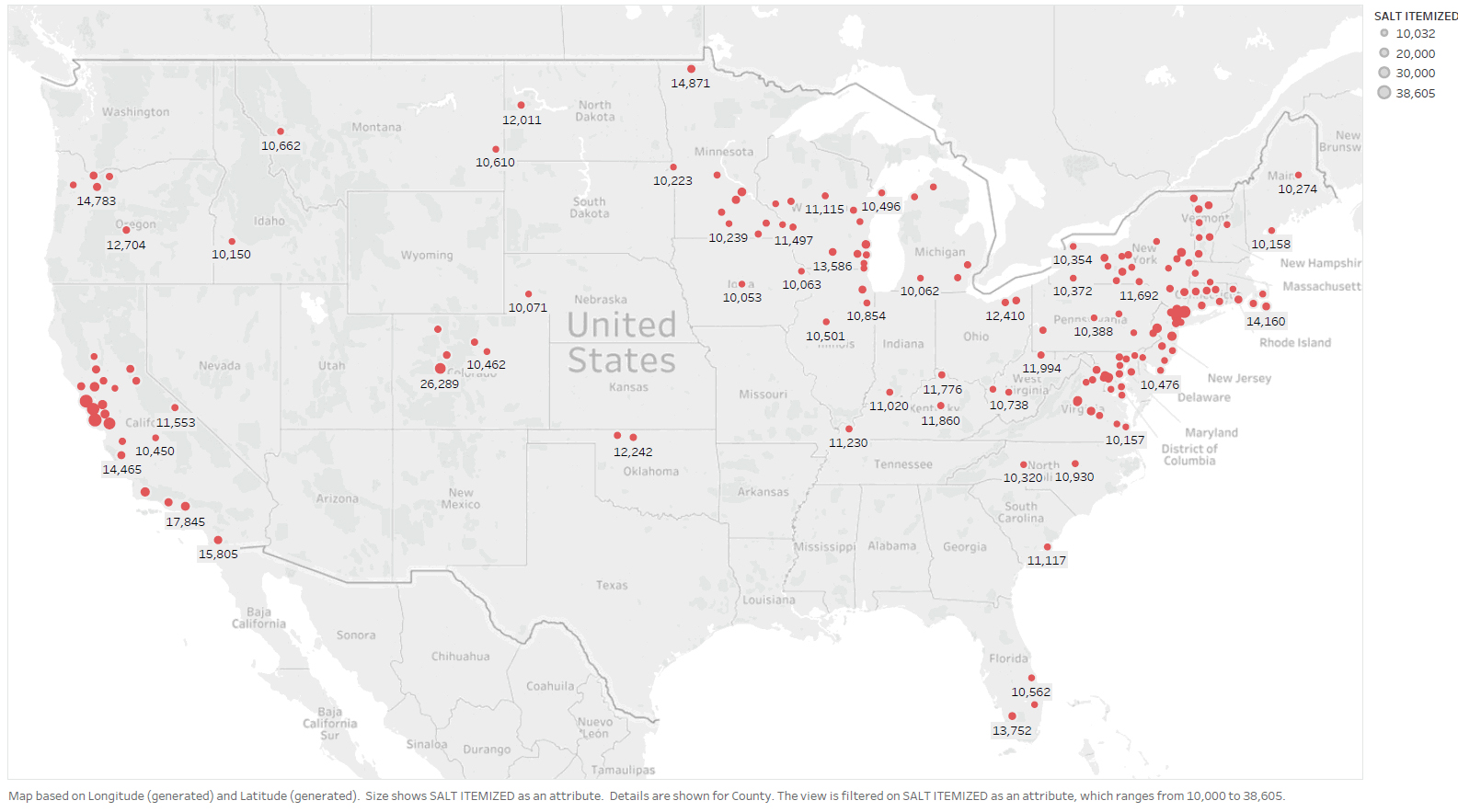

It remains to be seen how homeowners will react to the lower cap of interest deductions for new mortgages. On the surface, it’s relatively nuanced as the new cap is only $250K lower than the prior $1mm limit. Therefore, it should only impact a handful of mortgage borrowers in areas with very high home values. However, the $10k SALT deduction limitation could produce material adverse effects in states and counties with high state and local tax rates. For example, people may choose to move to areas with lower local tax rates or prospective homeowners may choose to purchase less valuable homes to limit their property tax bill. The question is, can we identify the specific municipalities that are most at risk of experiencing revenue shortfalls under the new SALT deduction limit?

Fortunately, our good friends at the Internal Revenue Service provide tax return statistics at the county level that we have cross-referenced with our Municipal Credits Database. According to IRS data for the 2015 tax year, about 30% of total tax filings used itemized deductions. So for more than 70% of taxpayers, the SALT cap is immaterial. Our analysis found that 10.72% of all counties in the US have SALT deductions of $10K or higher per itemized filer (Figure 2). Unsurprisingly, the lion’s share of these counties reside in states with high state and local tax rates. However, there are some outliers in counties that have a small number of taxpayers that claim significant SALT deductions despite the state imposing relatively low state and local tax rates. The Baker Group’s Municipal Credit Criterion Check (MCCC) tool now includes a filter that will flag issuers that reside in a county with more than $10K in SALT deductions per itemized return. Please contact your Baker representative if you would like a copy of the new SALT filter in the MCCC.

Only time will tell how municipal issuers deal with the credit challenges imposed by the TCJA, rising interest rates, falling tax collections, mounting pension obligations, and an economic recovery that is nearing the second longest in United States history. Municipal bonds continue to provide some of the most attractive yields for institutional portfolios, but investors must keep a close eye on credit quality to ensure best performance.

Figure 2: HEAT MAP - Counties with High State and Local Tax Deductions Drew Simmons serves as Senior Vice President at The Baker Group, where he works with community bank needs pertaining to interest rate risk, asset/liability management, and fixed income portfolio management. He created the firm’s municipal credits database, and is a frequent speaker at banking schools and financial seminars. Contact: 800-937-2257, drew@GoBaker.com.

Drew Simmons serves as Senior Vice President at The Baker Group, where he works with community bank needs pertaining to interest rate risk, asset/liability management, and fixed income portfolio management. He created the firm’s municipal credits database, and is a frequent speaker at banking schools and financial seminars. Contact: 800-937-2257, drew@GoBaker.com.