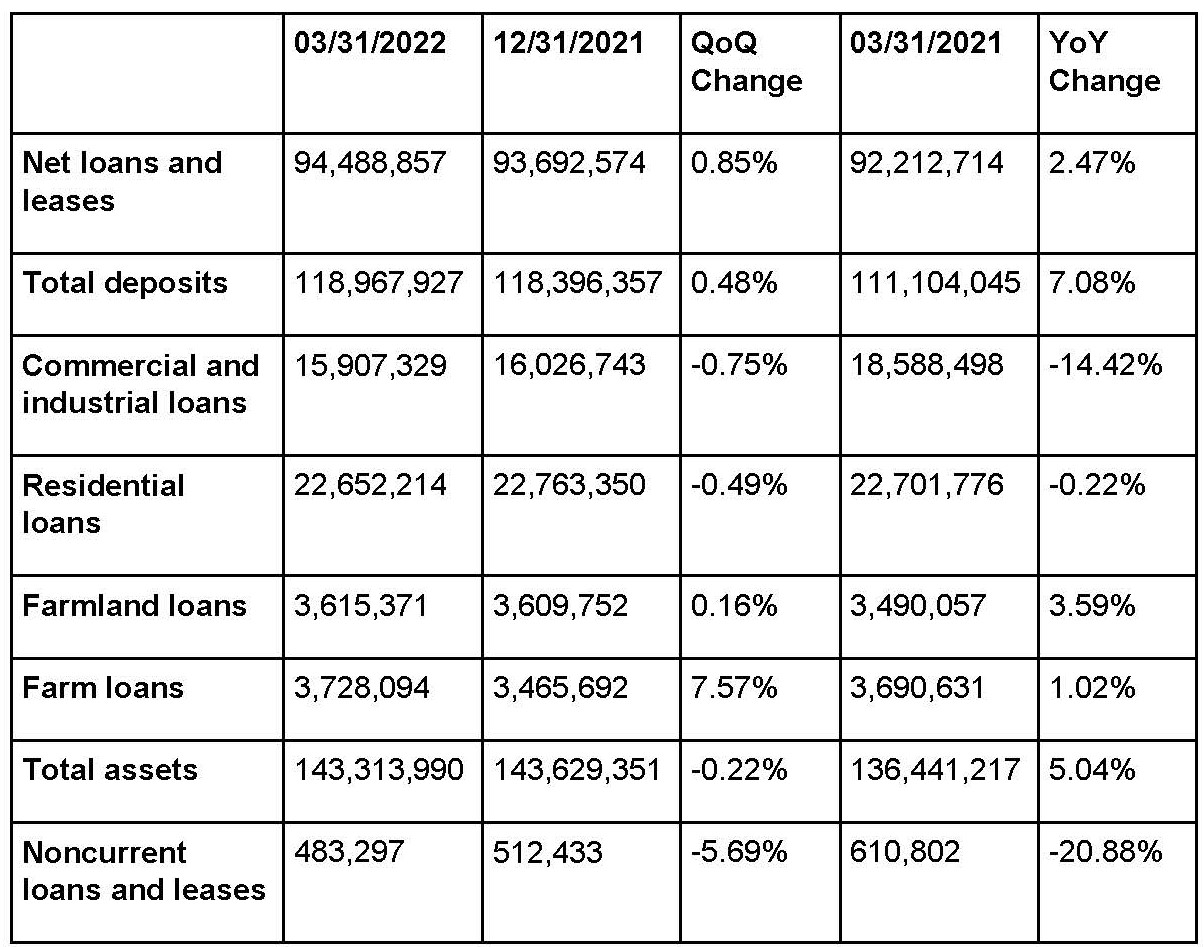

Wisconsin banks started the year 2022 strong with total assets up 5.04% year over year from March 31, 2021 to March 31, 2022. Despite concerns about rising inflation, total deposits were up 7.08% for the same period. The financial health of consumers was also evidenced by a 20.88% year-over-year decrease in noncurrent loans and leases.

Notable indicators include:

- Residential lending slowed only slightly as the housing market remained a hot sellers’ market.

- Commercial lending decreased 14.42% year over year. Supply chain issues and worker shortages continue to inhibit business growth and cause hesitancy among business owners to take out loans.

- Credit quality continues to improve as more borrowers are keeping up to date with their payments. Noncurrent loans and leases decreased 20.88% year over year and 5.69% quarter over quarter.

Statement on the release of first-quarter 2022 Federal Deposit Insurance Corporation (FDIC) numbers from Rose Oswald Poels, president and CEO of the Wisconsin Bankers Association:

“Wisconsin’s banking industry stands poised to meet the banking needs of Wisconsinites in 2022 as government pandemic relief funding phases out. Bankers will be keeping a close eye on global supply chain and geopolitical issues as well as the Fed’s rising interest rates going into the rest of the year.”

FDIC-Reported Wisconsin Numbers (Dollar Figures in Thousands)